Table of Content

They're all located in Tornado Alley — a region of the country that sees frequent tornadoes and hailstorms throughout much of the year. Below is the monthly and annual average home insurance cost by state and how it compares to the national average. The average annual rate for a home with $400,000 in dwelling coverage and $300,000 in liability and $1,000 deductible is about $3,231, according to a rate analysis by Insure.com. But rates vary significantly from state to state and from city to city. Alani Asis is a Personal Finance Reviews Fellow who covers life, automotive, and homeowners insurance.

Fortunately, there's a lot of data available to help you set realistic expectations for your homeowners insurance cost. This article will look at how much the average homeowner is paying in homeowners insurance premiums, the factors that affect your specific policy, and ways you can save. While the national and state average cost of homeowners insurance can give you ballpark figures, it’s not the most effective way to determine if your premium is competitive. Costs vary greatly by location as well as based on the amount of coverage you have. Instead, we recommend you first assess the level of homeowners insurance coverage you need and want and then compare quotes from various companies in your local area. Power, AM Best, Standards & Poor’s, National Association of Insurance Commissioners and Moodys had a significant impact on the companies’ Bankrate Scores.

Compare Your Homeowners Insurance Options

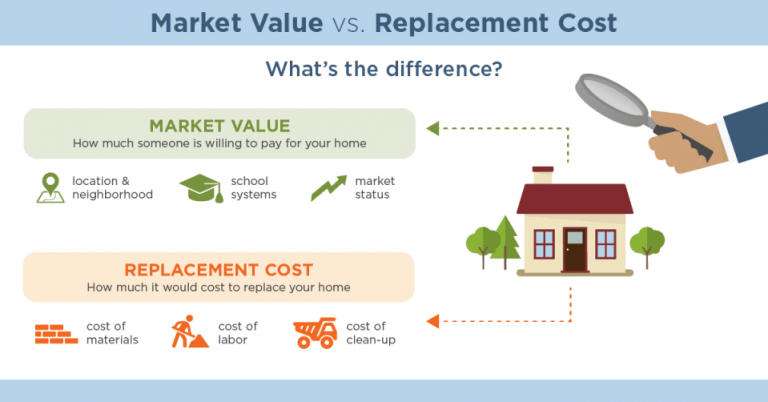

A homeowners policy typically covers losses and damages to your personal residence, as well as furnishings and certain other assets within your home. Home insurance may also offer liability coverage against certain types of accidents that occur within your home or on your property. We analyzed rates across the nation to find the average cost of homeowners insurance. Your exact price will depend on specific personal details, such as the location and age of your house and the coverage limits you choose. However, our analysis can give you an idea of what you might expect to pay. Typically, a standard home insurance policy includes sufficient dwelling coverage to completely rebuild the house.

How much you opt for dwelling coverage and any extra coverage add-ons is directly tied to your insurance premiums. Highercoverage limits and more specialized coverageadd-ons equals higher rates. The average cost of home insurance is typically more expensive for older homes versus new homes. This is because insurance companies consider older homes at greater risk of damage, meaning you're more likely to file a claim. As you can see in the table below, new homes have an average annual rate that's roughly $800 cheaper than homes that are 100 years old. The states with the cheapest average home insurance costs in 2022 are Hawaii, Vermont, New Jersey, Oregon, and Utah.

Other structures

The low rates are a result of all three states having a low risk of natural disasters. ValuePenguin collected and analyzed hundreds of thousands of quotes from every ZIP code across the country to find the average homeowners insurance rates in every state. Each policy is for a 2,100-square-foot home of the average age and value in the state where it's located.

Insurance carriers typically calculate replacement cost coverage as 50% to 70% of your dwelling coverage. Depending on the type of possessions you own, you might need more coverage. A home insurance policy may cover losses to your house but not damage to your furniture or other personal contents, even if the losses occur in the same event. Rebecca McClay is a financial content editor and writer specializing in personal finance and investing topics. For more than 15 years, she's produced money-related content for numerous publications such as TheStreet and MarketWatch, and financial services firms like TD Ameritrade and PNC Bank.

Recommended Personal Property Coverage Amounts

Policygenius Inc. (“Policygenius”), a Delaware corporation with its principal place of business in New York, New York, is a licensed independent insurance broker. The information provided on this site has been developed by Policygenius for general informational and educational purposes. We do our best to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application.

Power customer satisfaction score, financial strength, available digital tools and more. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site.

Explore the market once per year before your renewal to make sure you are not overpaying. Better deals are out there, and you can use Gabi’s free home insurance calculator and quoting tool to compare dozens of homeowners insurance quotes from different insurance providers side-by-side. Your homeowners insurance policy will only pay for certain perils listed on your policy. Make sure that you have sufficient coverage and ask your insurance agent about any add-ons you should purchase to protect your property and your pocket. Personal property is usually insured for 20% to 50% of your dwelling coverage limit. The GEICO Insurance Agency could help you get the affordable home insurance coverage you need.

Aside from your home’s value, location is one of the most important factors to impact home insurance coverage and costs. This is because your particular location has a lot to do with how insurance companies calculate potential risks. For example, if you live in an area prone to natural disasters like hurricanes or wildfires, you can expect your premiums to be higher. To determine how much personal property coverage you need, take a thorough inventory of your home’s contents and calculate how much it would take to replace each item.

The table below provides a look into the average annual cost of home insurance in different cities across the U.S. and how it compares to the state average. All rates are based on the above coverage limits except where otherwise noted. When analyzing costs for different coverage levels and risk factors, we changed just one variable at a time to ensure the rates we’re comparing are fair and representative of the factor at hand. The average rate for a house with $200,000 in dwelling coverage is about $2,233 for $300,000 in liability. For example, if a tree fell through your house and destroyed your couch, a replacement cost policy would pay whatever it costs to replace the couch. But a cash value policy would only pay what the couch is worth today.

For example, adding smart home technologies or a home security system can earn a discount. Buying your home and auto insurance from the same company, called bundling, can snag a discount, too. You can choose a liability limit for home insurance, which commonly starts at $100,000, although it’s wise to have enough to cover what could be taken from you in a lawsuit. Your house doesn’t come with infinite resources at its disposal when faced with uninsured disasters like natural ones, so everything else inside it ( TVs included!), does not stay trashed forever. At the same time, savings dwindle by day due to a lack of protection against accidents outside our control; their needs involve strategy employed before too long.

In some cases, an insurer may write a policy for 100% of replacement cost. But keep in mind that a standard home insurance policy will only pay up to its limit. You can increase your home’s protection by adding optional coverages to your standard home insurance policy. You can click here to get a few rates and get started, or check rates across the top home insurance companies based on the type of insurance coverage you need.

For example, despite the threat of earthquakes in California, standard homeowners insurance in the state does not cover earthquake damage. However, many insurance companies do not cover all types of natural disasters. You’ll also want to keep in mind your deductible, which is the amount that you must pay out of pocket before the insurance company will pay out a settlement on your claim. For example, AIG charges an average annual premium of $3,564, while Travelers charges only $1,415. A search for homeowners insurance for a $200,000 home with a $1,000 deductible and $300,000 liability in Eureka, California comes out to a $725 premium. You can get home insurance coverage within minutes of getting your quotes and applying.

Home insurance costs vary from company to company, as every company has its own particular way of calculating rates and evaluating risk. Based on our analysis of the cheapest home insurance companies, we found that Erie's average home insurance rate in the lowest, followed by Auto-Owners and USAA. The average homeowners insurance cost for $300,000 in dwelling coverage with $100,000 liability is $2,763. If you bump liability to the recommended amount of $300,000, homeowners insurance with dwelling coverage for a $300,000 house has a national average of $2,779. Homeowners insurance covers your dwelling, personal property, offers liability protection, and covers you for additional living expenses if your home becomes inhabitable due to damage.

You also need to be aware that if any aspects of your house increase in value over time. For example, appliances and furniture will likely not be covered if they get destroyed due to age. The size of your house also has a huge effect on how much you’ll pay for homeowners insurance. Thus, if you have a large family and own a larger home, then expect higher premiums just like everyone else living in that location with that same sized house.

No comments:

Post a Comment